?Oh, that was easy,? says Man, and for an encore goes on to prove that black is white and gets himself killed on the next zebra crossing.? ? Douglas Adams, The Hitchhiker?s Guide to the Galaxy

Have rising oil prices just put the final coffin nail in the entire 2009-2011 economic recovery?

Given the slowdown in China, the new recession in Europe, and the rocky bottom in the US economy, it certainly seems that way.

Oil?s Relentless March Higher

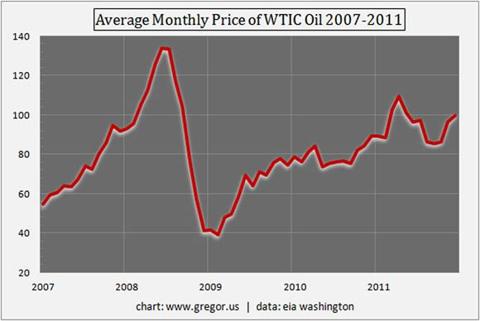

Oil prices emerged from their spider hole over two and half years ago. Having fallen from the towering heights of $148 a barrel in the summer of 2008, the early months of 2009 saw a return to prices in the $30s. Interestingly, during that great oil crash, the price of West Texas Intermediate Crude Oil (WTIC) spent only 20 trading sessions below $40. That is the exact price that most analysts only three years prior believed oil could never sustain as the world would pump ?like crazy? should prices ever reach such ?impossibly high levels.?

Given the enormous debt troubles the West is currently facing and the fact that oil has averaged over $100 during several months this year, it does seem reasonable to suggest that, once again, the economy has been pushed off a ledge by oil. Let?s take a look at oil prices over the past several years.

Although they won?t admit to it, many economists and older energy analysts have been simply blown away by the persistence of oil prices, especially in the weak economic environment post the 2008 crisis and financial market crash. How did oil prices manage to recover to $80 (let alone to $40 or $60), and make their way back all the way to $100? (And this is just a chart of WTIC oil. Brent oil has been even stronger the past year). Why, for example, has a 12% reduction in US demand and weak economies elsewhere in the OECD not translated to much cheaper oil prices? Why did oil not simply flatten out in price, post 2008? After all, many claimed oil was nothing but another in a series of ?Made in America? financial bubbles. With ?no shortage of global supply? (as many said), and with a market ?awash in oil? (as others said), why didn?t oil prices simply go to sleep at, say, $50 per barrel?

Do Higher Oil Prices Really Cause Recessions? (Answer: Yes)

Before we unpack some of the factors behind oil?s strength, I want to address the subject of oil prices and recessions. I think readers should be aware that some analysts reject any reflexive, easy causality between high oil prices and sharp contractions in the economy. There are a range of views on this topic, from those who embrace the idea of substitution to those who assert that oil prices and oil supply rise concurrently with movements in the economy.

Substitutionists tend to also be positive, or constructive, transitionists I might add. Many of these come from technical and engineering backgrounds, and often have very good exposure to economic theory. In their view, higher oil prices drive human innovation and spur entrepreneurs to create new technology. High oil prices for them are actually a positive. Understandably, they also want all subsidies and other externalities, which we pay as a society to the fossil fuel industry, to be phased out. And frankly, I sympathize with that view.

Meanwhile, analysts who see the relationship between energy supply and the economy as more equalized, more symbiotic if you will, tend to hold the view that if the economy demands more oil ? and is willing to pay the price ? then the earth will reliably ?give it up? to the resource extractors over time. You can see this view very much at play currently, in the excitement over natural gas and also oil extracted from shale. Indeed, the learning curve, in which the hydraulic fracturing technique moved from experimentation to perfection, conforms very much to theory.

If one expands on these two schools of thought ? human innovation that conquers limitations, and a symbiotic view of the economy and energy supply ? it becomes rather easy to imagine that high oil prices present a real but rather small problem for the economy.

Of course, I take a different view.

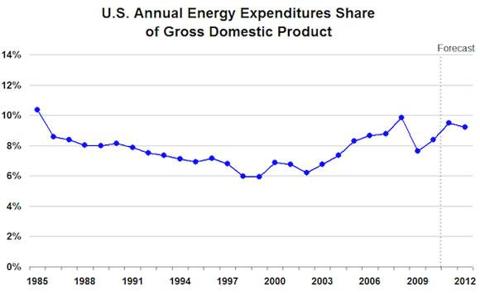

Writing with my friend and colleague Chris Nelder at the HBR Blog earlier this fall, we warned of not one but two risks associated with stubbornly high oil prices. First, we referred generally to the history of oil spikes and recessions, noting that in the post-war US economy, one generally followed another. For an economy that has been geared towards oil for many decades, this should come as no surprise, especially when energy expenditures rise over certain thresholds, as they did in the 1970s, and again more recently. But we also warned that an over-confidence had developed over the decades, especially in America, and that any pressure from energy prices was ultimately solvable. And we encouraged corporate management to be more skeptical of the idea that the global oil and gas industry would be able to continue bringing to market resources that most could afford.

One of the more thoughtful reactions to our essay came from Michael Levi at the Council on Foreign Relations. Levi called into question whether any reliable threshold existed, regarding energy expenditures to GDP, that would trigger recession once crossed. In a general sense, that strikes me as reasonable. And to clarify, the notion of proving a magical threshold ? say, when energy expenditures to GDP rise above 5% ? was not exactly our central point. Indeed, I would agree with Levi more specifically that the rate of change might be at least as damaging, if not more so, than any threshold. In Does Expensive Oil Inevitably Cause Recession?, Levi also makes an additional point worthy of attention:

There is, however, a possible back door explanation for why high petroleum expenditures relative to GDP seem to correlate with recessions even if they don?t do a good job explaining them: it is easier for petroleum expenditures to undergo big changes in short periods of time if they are starting from a high level. If, say, the price of oil rises 50% from a starting point where petroleum expenditures are 2% of GDP, the change in spending is 1% of GDP; in contrast, if the price of oil rises the same 50% from a starting point where petroleum expenditures are 6% of GDP, the change in spending is 3% of GDP. Whatever your transmission mechanism ? supply side contraction, demand destruction, shifts in consumer preferences for durable goods ? the 3% jump is going to be far more economically damaging than the 1% one. Indeed the years where oil spending was high but recession was absent generally come from a period where prices were fairly stable.

(Source)

As we look at the historical table from EIA Washington, showing expenditures to GDP from 1949-2010 (pdf), illustrative to Levi?s point are the levels from which we rose, starting in 2004. Because in 2003, the level was already sitting at 6.8%. But in 2005, it rose to 7.3%, and then reached the very high level of 9.8% in 2008. Today I am mainly concerned with the outlook to 2012, given that the global economy was granted only the most brief reprieve from high energy prices in 2009, before resuming in 2010 and this year, 2011. To provide the most to up-to-date data, let?s also look at the chart, also from EIA Washington:

Understanding Causality

It is difficult to satisfy a demand for precision ? when asserting that high energy prices, or fast rates of change in energy prices, or energy-prices-to-GDP thresholds ? has caused a recession. The most significant hurdle lies in the organic complexity of the economy itself. With all of its political and cultural variances, and the mercurial nature of social moods and trends, how does one make certain claims about such a large system?

Some have suggested therefore that high or rising oil prices cause changes in GDP ? and hence, recession. To try to put this in layman?s terms, Clive Granger attempts to assert causality within a more uncertain matrix, saying essentially that certain events follow others reliably, but in a sequence where causality is difficult to quantify. As has been pointed out by some, Granger is unfortunately paired with the word causality, when in fact it is really a test or a method by which to determine predictability. (For some of the best work on energy prices and recessions, and Granger Causality, I point readers to the work of James Hamilton, who also runs the popular macroeconomics blog, Econbrowser.)

A broader discussion of the economic impact of energy prices would also include the problem of energy transition. Or, if you like, the broader subject of adaptation. For example, perhaps oil-induced recessions historically were exacerbated or ultimately made possible by policy mistakes. It once was the habit of central banks to raise interest rates in the face of higher oil prices. But what if the economy had simply been left to handle higher prices on its own? More recently, Ben Bernanke has allowed that the central bank cannot control oil.

There?s not much the Fed can do about gas prices per se. After all, the Fed can?t create more oil. We don?t control emerging markets. ~ Ben Bernanke, 2011

This suggests an evolution in thinking over his predecessors. Could the economy adapt better to resource price pressures if policy mistakes were not a feature of the economy?

I?m not so convinced of that, either. After all, the volatility in free markets can have its own deleterious effect on new investment. One of the most vexing features of any reliance on high fossil fuel prices alone, as a trigger for investment in alternative energy, is the volatility of prices. If those with capital are to be encouraged to invest in new energy technologies, many of which capture more diffuse energy ? or which create energy, but at a higher cost ? then there must be some confidence that cheap fossil fuels will not re-enter the scene, making new investment uneconomic. Encouragingly, that particular issue now looks more resolved than ever because the price of the master commodity ? oil ? which is still the primary energy source of the world, is now structurally higher and is almost certain to stay that way.

Asking the Right Question

And so, to answer the question, Do high energy prices cause recessions? I would say with full respect to uncertainty and causality, yes. Eventually, however, the energy transition away from fossil fuels will gather enough momentum that we will interpret high-energy prices differently: We will say they (helpfully) forced a necessary transition. But as we are so early in any global transition to alternatives, it would be better for economists, policy makers, and business to consider the Douglas Adams quote that?s in the header of this essay. Trying to prove that black is white may be a noble effort, in the fullness of epistemology and causality, but in the short term it could get you run over in a crosswalk.

We face a more immediate question: Is the global economy headed back into recession in 2012? Almost certainly, I think.

Source: http://seekingalpha.com/article/315656-why-oil-prices-are-killing-the-economy?source=feed

the waltons the waltons weta weta rudolph the red nosed reindeer rudolph the red nosed reindeer adam carolla

No comments:

Post a Comment